Foreclosure is a daunting and distressing process that many homeowners face when they are unable to keep up with their mortgage payments. In Michigan, the foreclosure process can be particularly challenging.

But what happens if a foreclosed home is not sold? In this article, we will explore the implications and consequences when a foreclosed home fails to find a buyer, as well as how to sell your house to avoid foreclosure.

What Is the Foreclosure Process in Michigan?

Before delving into the consequences of an unsold foreclosed home, it’s essential to understand the foreclosure process specific to Michigan. In this state, both judicial and non-judicial foreclosure processes are utilized. Judicial foreclosure involves a court-supervised process, while non-judicial foreclosure is carried out without court involvement.

The foreclosure process in Michigan begins with the lender filing a lawsuit against the homeowner. Following this, a series of legal notices, including the Notice of Sale, are required to be posted. These notices inform the homeowner and the public about the impending foreclosure sale. The timeline for the foreclosure process can vary, but typically, it takes several months to complete.

Foreclosure Auctions in Michigan

When a foreclosed home goes up for sale, it is usually through a foreclosure auction conducted by the county sheriff. The auction provides an opportunity for potential buyers to bid on the property. The highest bidder at the auction becomes the winning bidder and takes possession of the property.

However, if a foreclosed home fails to sell at the auction, the situation becomes more complicated. In such cases, the property becomes a Real Estate Owned (REO) by the foreclosing lender. The lender then takes ownership of the property and must decide on the next steps.

If the Home Doesn’t Sell at Auction

When a foreclosed home doesn’t sell at auction, it becomes the responsibility of the foreclosing lender. The lender must assess

- The property’s condition

- Market value

- Potential for resale.

Depending on these factors, the lender may choose to list the property for sale on the open market. Selling an unsold foreclosed property is not always an easy task for the lender. They may face challenges such as property maintenance, security, and selling costs. Additionally, the lender must consider the potential impact on the former homeowner and the broader community.

Impact on the Former Homeowner

For the former homeowner, the consequences of an unsold foreclosed home can be significant.

- Deficiency judgment: One such consequence is the possibility of a deficiency judgment. This occurs when the sale of the property does not cover the full amount owed on the mortgage. The former homeowner may be held responsible for paying the remaining balance.

- Homeowner’s credit: Foreclosure can also have a detrimental impact on the former homeowner’s credit. It can stay on their credit report for several years, making it challenging to secure future loans or credit.

- Homeowner rights: The former homeowner may face legal rights and potential obligations post-auction, depending on the specific circumstances.

Handling of REO Properties by Banks

When a foreclosed home becomes an REO property, the bank or lender must manage it appropriately. This involves listing and selling the property on the open market. Banks typically work with real estate agents to market and sell REO properties.

In addition to the selling process, banks must also handle the maintenance, security, and selling costs associated with REO properties. These properties often require repairs and upkeep to attract potential buyers. The bank must also consider the financial impact of holding onto these properties while they are on the market.

Economic and Community Impact

The impact of unsold foreclosed homes extends beyond the individual homeowners and lenders. It also affects the broader economy and community. When foreclosed homes remain vacant and unsold, it can lead to a decline in property values in the surrounding area. This can create instability within the local real estate market and negatively impact the overall neighborhood stability.

To address the issue of foreclosure, various state and local government initiatives have been implemented. These initiatives aim to provide assistance to homeowners facing foreclosure and to mitigate the negative effects on communities.

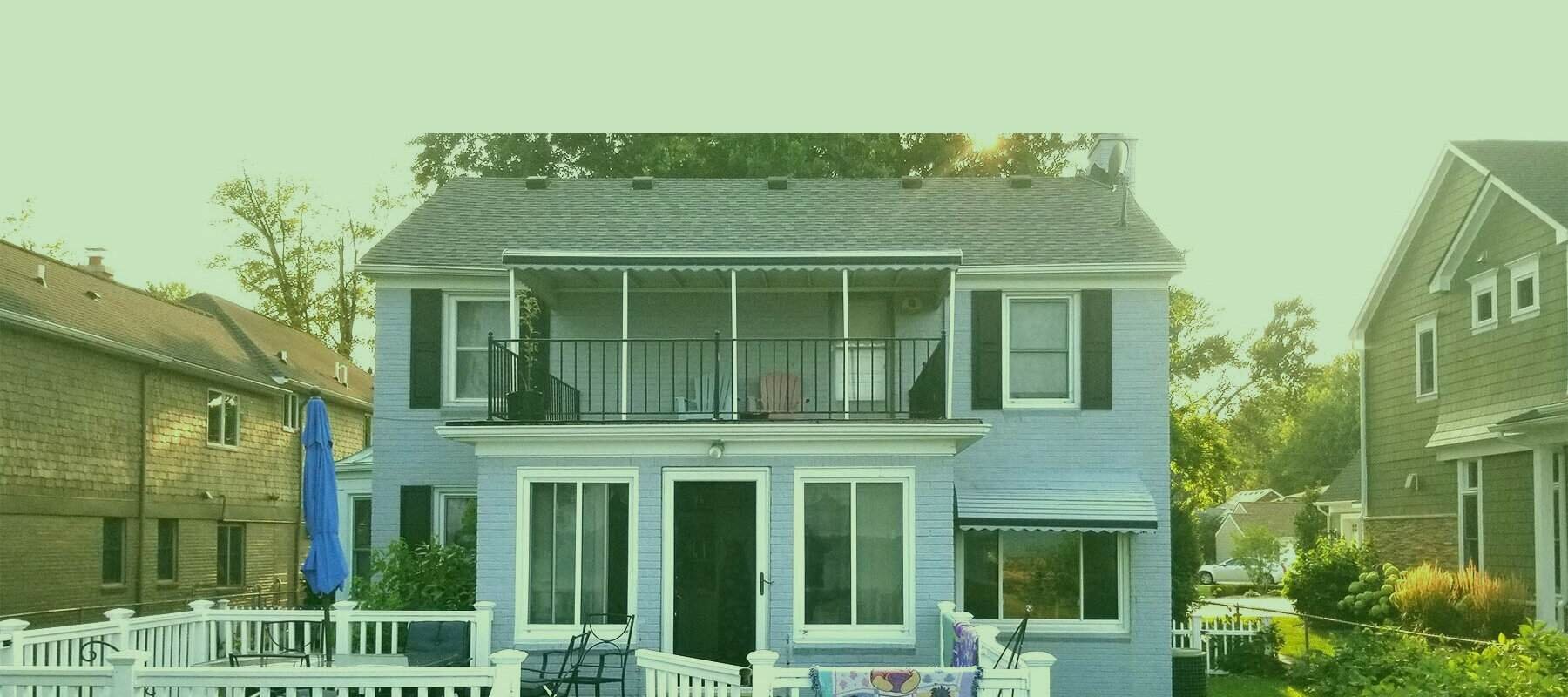

Cash Home Sale: An Alternative to Foreclosure

While foreclosure is a challenging situation, there are alternatives to consider. One viable option is a cash home sale. A cash sale allows homeowners to sell their property quickly and avoid the complications of foreclosure auctions and REO management.

By selling their home for cash, homeowners can receive a fair offer and close the deal within a short timeframe. This provides them with the opportunity to settle their debts and move on without the long-lasting consequences of foreclosure.

Managing Foreclosure

When a foreclosed home fails to sell, it becomes the responsibility of the foreclosing lender. The lender must assess the property and decide on the next steps, which may include listing the property on the market.

The impact on the former homeowner can be significant, with potential credit implications and legal obligations. Managing unsold foreclosed properties also poses challenges for banks. The broader economic and community impact of unsold foreclosed homes cannot be overlooked. Exploring alternatives, such as cash home sales, can provide homeowners with a way to avoid the complications of foreclosure.

We Buy Houses in Detroit, Michigan

If you need to sell your house fast but don’t want the hassle of a traditional home sale, contact M1 Home Buyers. We buy houses as-is. No repairs are needed. Avoid closing costs and realtor commissions. Close in as little as seven days. Call 248-397-5800 to get a fast cash offer from our local home buyers.