Selling your house can be a daunting experience, particularly if you don’t have experience in the real estate market. One of the most significant concerns for homeowners is capital gains tax. When you sell your home, you may be liable to pay capital gains tax, which can significantly reduce your profits.

In this article, we will explore what capital gains tax is, how it works, and how you can reduce or avoid it when selling your home. If you’re planning to sell your house fast in Detroit, Michigan, keep reading to learn about the best ways to avoid capital gains tax.

Understanding Capital Gains Tax

Capital gains tax is a tax on the profit you make when you sell an asset, such as a house. If you sell your house for more than you paid for it, you will be liable to pay capital gains tax on the profit you made. The amount of tax you pay depends on several factors, including your income, the length of time you owned the house, and the amount of profit you made.

The Internal Revenue Service (IRS) collects capital gains tax, and the tax rate depends on your income tax bracket. If you’re in a higher tax bracket, you’ll pay a higher rate of capital gains tax. In general, the capital gains tax rate ranges from 0% to 20%, depending on your income.

Calculating Capital Gains Tax on Home Sales

Calculating capital gains tax on home sales can be complicated. To calculate your capital gains tax liability, you’ll need to know the following information:

- The purchase price of your home

- The cost of any improvements you made to the home

- The selling price of your home

- Any selling expenses, such as real estate agent fees, closing costs, and legal fees

To calculate your capital gains tax liability, you’ll need to subtract the purchase price, the cost of improvements, and selling expenses from the selling price. The resulting amount is your capital gain, and you’ll need to pay tax on that amount.

How to Reduce or Avoid Capital Gains Tax

Fortunately, there are several ways to reduce or avoid capital gains tax when selling your home. The first way is to take advantage of the tax exclusion for primary residences. If you’ve owned and lived in your home for at least two out of the past five years, you may be eligible for a tax exclusion of up to $250,000 if you’re single, or up to $500,000 if you’re married filing jointly.

Another way to reduce capital gains tax is to keep track of any home improvements you make. You can add the cost of improvements to your home’s basis, which will reduce the amount of gain you have to pay tax on. For example, if you bought your home for $300,000 and spent $50,000 on improvements, your basis would be $350,000. If you sell your home for $500,000, you’ll only have to pay tax on the $150,000 gain, not the full $200,000.

Sell Your House Fast to Avoid Capital Gains Tax

If you’re looking to avoid capital gains tax altogether, you can sell your house fast. Selling your house fast means you can sell your home before you’re liable to pay capital gains tax. This can be an excellent option if you’re looking to move quickly or need cash urgently.

One way to sell your house fast is to work with a cash home sale company. These companies buy homes for cash, often in as little as seven days. This can be a great option if you’re looking to avoid the hassle of listing your home on the market, dealing with real estate agents, and waiting for a buyer to come along.

Benefits of Cash Home Sales

Cash home sales offer several benefits for homeowners looking to sell their homes quickly. One of the most significant benefits is that you don’t have to worry about the hassle of listing your home on the market, dealing with real estate agents, and waiting for a buyer to come along.

Another benefit of cash home sales is that you can sell your home as-is, without having to make any repairs or renovations. This can save you time and money and can be an excellent option if you don’t have the time or money to make improvements before selling.

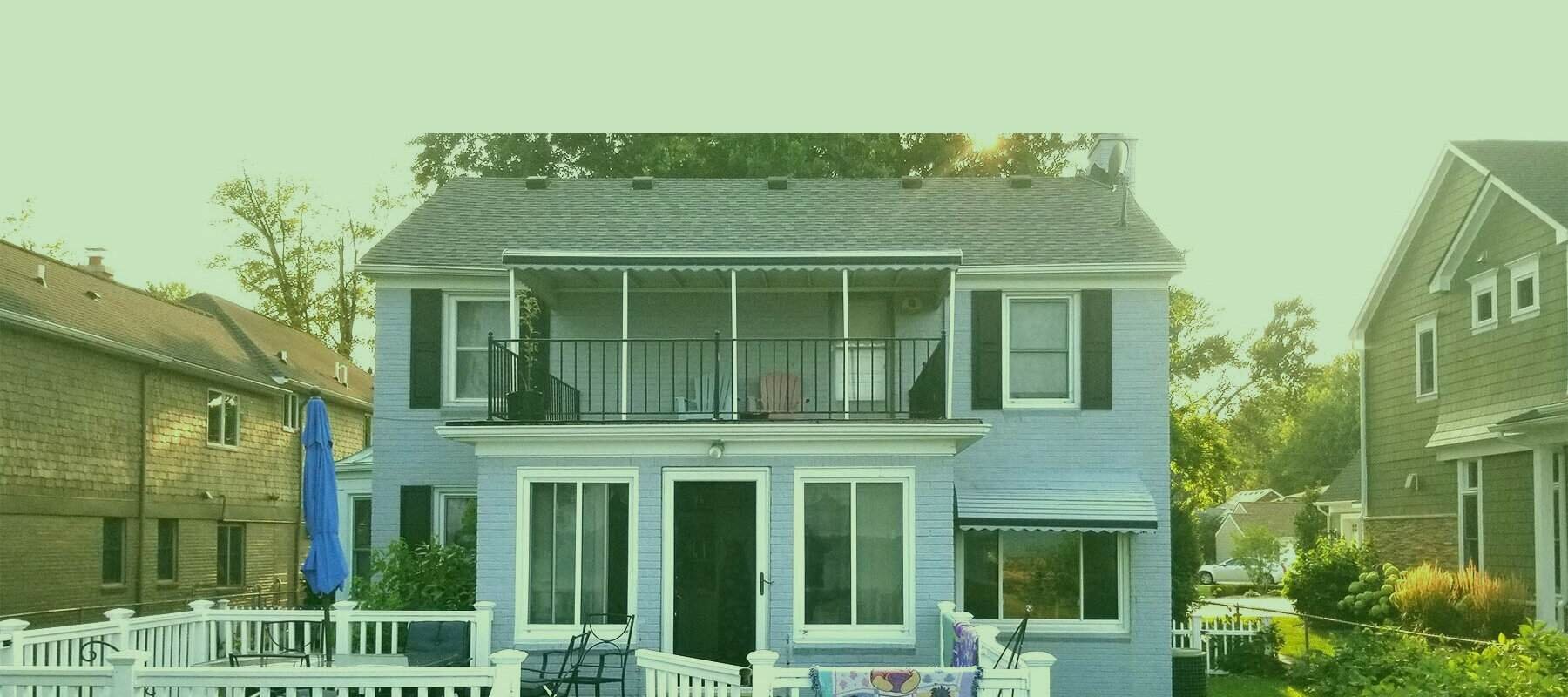

The Real Estate Market in Detroit, Michigan

If you’re looking to sell your home in Detroit, Michigan, there are several factors you should consider. Detroit has a relatively stable real estate market, with a median home value of $48,000. However, the market can be competitive, with many homes for sale, which can make it challenging to sell your home quickly.

One way to speed up the home selling process in Detroit is to work with a cash home sale company. These companies can offer you cash for your home, often in as little as seven days, which can be an excellent option if you’re looking to move quickly or need cash urgently.

Making the Right Choice for Your Home Sale

Selling your home can be a stressful experience, especially if you’re worried about paying capital gains tax. However, there are several ways to reduce or avoid capital gains tax, including taking advantage of the tax exclusion for primary residences, keeping track of home improvements, and selling your home fast.

If you’re looking to sell your home fast, selling your house as-is for cash can be an excellent option. It can save you time and money, and you can avoid the hassle of listing your home on the market.

We Buy Houses in Detroit, Michigan

If you need to sell your house fast but don’t want the hassle of a traditional home sale, contact M1 Home Buyers. We buy houses as-is. No repairs are needed. Avoid closing costs and realtor commissions. Close in as little as seven days. Call 248-397-5800 to get a fast cash offer from our local home buyers