Foreclosure is a distressing situation that many homeowners face at some point in their lives. It can have significant financial implications and leave individuals wondering what will happen to their equity and any money they might receive.

In this article, we will explore the financial outcomes of foreclosure, its impact on credit and future financial implications, the tax implications involved, and discuss an alternative option to foreclosure: selling your home for cash.

Understanding Foreclosure

Foreclosure is a legal process where the lender files a lawsuit to repossess a property due to the homeowner’s failure to make mortgage payments.

The circumstances that lead to foreclosure can vary, but they usually involve situations where homeowners face financial difficulties, such as

- Job loss

- Medical emergencies

- Excessive debt.

Once the foreclosure process begins, the homeowner receives a notice of sale, and eventually, the property goes through a foreclosure auction.

Financial Outcomes of Foreclosure

When a house is foreclosed, the financial outcomes can vary depending on the specific circumstances.

- If there is equity in the home, it means that the property’s value is higher than the outstanding mortgage balance. In this case, the homeowner may receive some money after the foreclosure sale, once the mortgage lender is paid off. However, the foreclosure sale price is often lower than the market value of the property.

- Homeowners may not receive any money after foreclosure. This can occur when the mortgage loan exceeds the property’s value, commonly known as being “underwater.”

- If a deficiency judgment is issued, it means that the homeowner is responsible for paying the remaining balance on the mortgage loan after the foreclosure sale. This can have a significant financial impact and make it even more challenging for individuals to recover from the foreclosure process.

Impact on Credit and Future Financial Implications

Foreclosure can have a severe impact on credit scores and future borrowing abilities.

- It can remain on your credit report for up to seven years. This negative mark can make it difficult to obtain new credit, such as loans or credit cards, and even affect employment opportunities.

- Lenders and landlords view foreclosure as financial instability and may be hesitant to extend credit or offer housing.

- It can be difficult to qualify for favorable interest rates on future loans, potentially costing you thousands of dollars in additional interest payments.

- It can also affect your ability to purchase a new home in the future, as many lenders require a waiting period before considering loan applications from individuals with a history of foreclosure.

Tax Implications of Foreclosure

In addition to the financial and credit impact, foreclosure can also have tax implications. In the past, homeowners were required to pay taxes on any debt forgiven by the lender as a result of foreclosure.

However, the Mortgage Forgiveness Debt Relief Act, enacted in 2007, provides relief for qualified homeowners. Under this act, individuals may be exempt from paying taxes on forgiven mortgage debt, up to a certain amount.

It’s important to consult with a tax professional or the Department of Housing and Urban Development (HUD) to understand the specific tax implications in your situation. They can provide guidance on how the Mortgage Forgiveness Debt Relief Act applies to your foreclosure and whether you are eligible for any tax relief.

Alternative: Selling Your Home for Cash

If you are facing foreclosure and want to avoid the negative consequences discussed above, one alternative to consider is selling your home for cash. Cash home sales involve selling your property quickly and directly to a real estate investor or cash home buyer. This option allows you to bypass the traditional real estate market, avoid foreclosure, and potentially receive cash for your home.

The process of selling your home for cash is straightforward and typically faster than going through foreclosure. Cash buyers often purchase properties in any condition, so you don’t need to worry about making repairs or improvements. Cash sales can help you avoid the financial and credit repercussions of foreclosure, giving you a fresh start and the opportunity to move on from this challenging situation.

Comparing Cash Sales and Foreclosure

When comparing the outcomes of foreclosure versus a cash sale, there are several key differences to consider.

- In terms of financial recovery, a cash sale can provide homeowners with immediate cash for their property. While the amount may be lower than the market value, it can still be a significant sum that can help individuals start anew.

- In terms of credit impact, a cash sale does not have the same long-lasting negative effect as foreclosure. While a foreclosure can stay on your credit report for up to seven years, a cash sale does not have a direct impact on your credit score. This allows you to rebuild your credit faster and have a better chance of qualifying for loans and credit in the future.

Foreclosure can be a lengthy and stressful process, often taking months or even years to complete. On the other hand, a cash sale can be finalized in a matter of days or weeks, allowing homeowners to quickly move on and regain control over their financial situation.

Steps to Take if Facing Foreclosure

If you are at risk of foreclosure, there are proactive steps you can take to help mitigate the situation. Seek financial advice from a housing counselor or a reputable financial professional. They can provide guidance on your specific circumstances and help you explore available options.

Communicate with your mortgage lender. They may be willing to work with you to find a solution, such as loan modification or a repayment plan. Additionally, consider exploring the possibility of selling your home for cash. This alternative can help you avoid the foreclosure process altogether and potentially provide you with the financial relief you need.

Facing foreclosure is a challenging and distressing situation for any homeowner. Understanding the financial outcomes, credit impact, and tax implications is crucial for making informed decisions. Exploring alternatives such as selling your home for cash can provide a way to avoid foreclosure and its long-term consequences. Remember to seek professional advice and take proactive steps to protect your financial well-being.

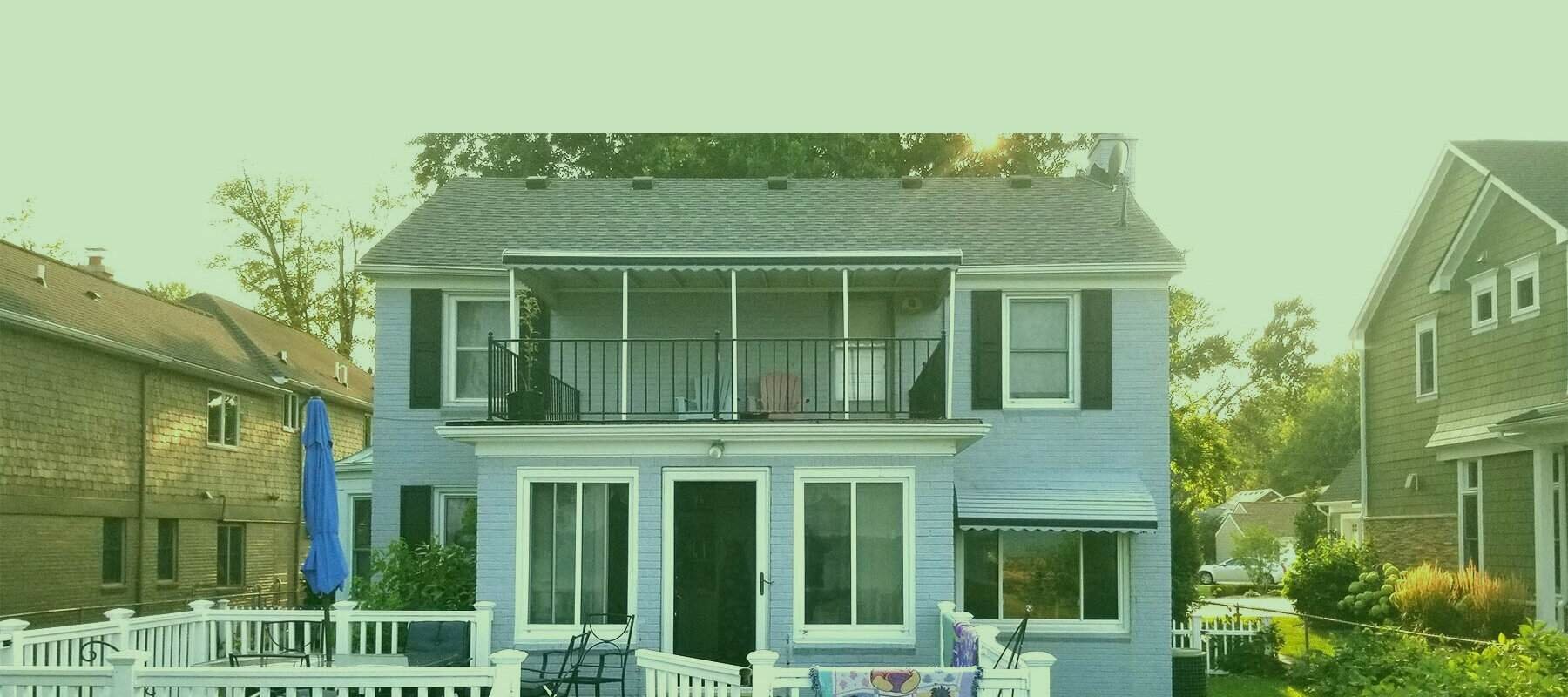

We Buy Houses in Detroit, Michigan

If you need to sell your house fast but don’t want the hassle of a traditional home sale, contact M1 Home Buyers. We buy houses as-is. No repairs are needed. Avoid closing costs and realtor commissions. Close in as little as seven days. Call 248-397-5800 to get a fast cash offer from our local home buyers.