In Michigan, when a loved one passes away and leaves behind property, their estate often goes into probate. Probate is the legal process of distributing a deceased person’s estate according to their will or state laws if there is no will. One common question that arises during this process is whether a house in probate can be sold.

Below, we explore the implications of selling a house in probate in Michigan, the legal considerations involved, and the steps you need to take to navigate this complex process.

How Does Probate Work in Michigan?

Before we delve into the specifics of selling a house in probate, it’s important to understand the probate process in Michigan. Here is an overview of the steps involved:

- Filing a petition: The process begins with filing a petition with the probate court to open the probate case. This petition should include information about the deceased person, their will (if any), and the names of their family members.

- Appointing a personal representative: The court will appoint a personal representative, also known as an executor or administrator, to manage the deceased person’s estate. This person will be responsible for handling the sale of the house in probate.

- Identifying and inventorying assets: The personal representative must identify and inventory all the assets of the deceased person’s estate, including the house that is to be sold.

- Notifying creditors and beneficiaries: The personal representative is required to notify known creditors and beneficiaries about the probate proceedings. This allows creditors to make claims against the estate and beneficiaries to assert their rights to inheritance.

- Paying off debts: Before the house can be sold, any outstanding debts of the deceased person must be paid off using the assets of the estate.

- Obtaining court approval: In Michigan, the court must approve the sale of a house in probate. The personal representative must file a petition with the court, providing details about the proposed sale and seeking approval.

- Selling the house: The personal representative is responsible for negotiating the sale price and finalizing the transaction. The sale proceeds will go into the deceased person’s estate.

- Distributing proceeds: After the sale, the personal representative must distribute the proceeds among the beneficiaries according to the court’s instructions.

Why Is Probate Important in Property Distribution?

Probate is important when it comes to distributing property in Michigan because it ensures a fair and orderly distribution process. During probate, the court oversees the administration of the deceased person’s estate, verifying the validity of the will (if any) and ensuring that the property is distributed according to the deceased person’s wishes or state laws.

By going through the probate process, the court can validate the authenticity of the will, resolve any disputes among family members, and ensure that creditors are paid before the distribution of assets. This helps protect the rights of all parties involved and prevents potential conflicts that could arise if the property were distributed without proper legal processes.

Michigan Probate Laws You Should Know About

When selling a house in probate in Michigan, it is essential to be aware of the specific laws and regulations governing the process. Here are a few key points to keep in mind:

- Court approval: In Michigan, the court must approve the sale of a house in probate. The personal representative must file a petition with the court, providing details of the proposed sale and seeking approval.

- Notice to interested parties: The personal representative is required to provide notice to all interested parties, including family members, creditors, and beneficiaries. This ensures that everyone has an opportunity to participate in the probate proceedings and voice any concerns they may have.

- Fair market value: When selling a house in probate, it is important to obtain a fair market value for the property. This ensures that the beneficiaries receive their rightful share and protects the personal representative from any accusations of undervaluing the property.

- Distribution of proceeds: After the sale, the personal representative must distribute the proceeds among the beneficiaries according to the court’s instructions. This distribution must be done in a fair and equitable manner, taking into consideration any debts, taxes, or expenses that need to be paid from the estate.

What Is the Difference Between Testate and Intestate Probate in Property Sales?

When it comes to probate and property sales, there are two terms you should be familiar with: testate and intestate probate.

Testate Probate

Testate probate refers to a situation where the deceased person left behind a valid will. In this case, the distribution of their property will be carried out according to the instructions outlined in the will. The personal representative appointed by the court will ensure that the property is sold in accordance with the wishes expressed in the will.

Intestate Probate

Intestate probate occurs when the deceased person did not leave behind a valid will. In this situation, the distribution of their property will be governed by Michigan’s intestacy laws. These laws determine how the property will be divided among the deceased person’s family members, typically starting with a surviving spouse and children.

Understanding whether the probate is testate or intestate is crucial, as it determines the legal framework under which the house sale will take place and who will be entitled to the proceeds from the sale.

How Do I Sell Property During Probate?

Selling a house during probate in Michigan involves several important steps:

- Obtain court approval: The first step is to obtain court approval for the sale. The personal representative must file a petition with the court, providing details about the proposed sale and seeking approval.

- List the property: Once court approval is obtained, the personal representative can list the property for sale. They may choose to work with a real estate agent or explore other options, such as selling to real estate investors.

- Negotiate the sale: The personal representative is responsible for negotiating the sale price and terms with potential buyers. They should ensure that the sale price is fair and reflective of the property’s market value.

- Obtain necessary documentation: The personal representative must gather all the necessary documentation required for the sale, such as the deed, title insurance, and any other relevant paperwork.

- Court oversight: Throughout the process, the court will oversee the sale to ensure that it is conducted properly and in the best interests of the estate and the beneficiaries.

- Finalize the sale: Once a buyer is found and an agreement is reached, the personal representative must finalize the sale. This involves signing the necessary paperwork and transferring ownership of the property to the buyer.

- Distribution of proceeds: After the sale, the personal representative must distribute the proceeds from the sale among the beneficiaries as directed by the court.

Navigating the process of selling a house during probate can be complex, so it is recommended to seek legal guidance from an experienced probate attorney to ensure compliance with all legal requirements.

What Are the Legal Requirements for a House Sale During Probate?

In Michigan, there are specific legal requirements that must be followed when selling a house in probate.

Court Approval

As previously mentioned, the court must approve the sale of a house in probate. The personal representative must file a petition with the court, providing details about the proposed sale and seeking approval.

Obtaining Necessary Documentation

The personal representative must gather all the necessary documentation required for the sale, such as the deed, title insurance, and any other relevant paperwork. These documents are essential for transferring ownership of the property to the buyer.

Notice to Interested Parties

The personal representative is required to provide notice to all interested parties, including family members, creditors, and beneficiaries. This gives them an opportunity to participate in the probate proceedings and voice any concerns they may have.

Fair Market Value

When selling a house in probate, it is important to obtain a fair market value for the property. This ensures that the beneficiaries receive their rightful share and protects the personal representative from any accusations of undervaluing the property.

Court Oversight

The court plays a vital role in overseeing the sale process. They will review the proposed sale, assess its fairness, and ensure that all legal requirements are met.

How Do I Close the Sale of a House in Probate?

Closing the sale of a house in probate involves several important steps. Here is a breakdown of what needs to be done:

- Finalize the sale: Once a buyer is found and an agreement is reached, the personal representative must finalize the sale. This involves signing the necessary paperwork and transferring ownership of the property to the buyer.

- Obtain court confirmation: After the sale is finalized, the personal representative must obtain court confirmation of the sale. This confirms that the sale was conducted properly and in compliance with all legal requirements.

- Ensure legal and procedural requirements are met: The personal representative must ensure that all legal and procedural requirements are met for the closing. This includes resolving any outstanding issues, paying off debts, and obtaining necessary approvals.

- Distribute proceeds: After court confirmation, the personal representative must distribute the proceeds from the sale among the beneficiaries as directed by the court. This distribution must be done in a fair and equitable manner, taking into consideration any debts, taxes, or expenses that need to be paid from the estate.

Closing the sale of a house in probate can be a complex process, so it is important to work closely with an experienced probate attorney to ensure that all legal requirements are met and the sale is successfully completed.

What Are Potential Challenges and Solutions When Selling a House During Probate?

Selling a house during probate can present various challenges and potential disputes among heirs or creditors. Here are some common challenges that may arise and strategies for resolving them:

In some cases, family members may have differing opinions on the sale of the house. It is important to encourage open communication and seek consensus among the heirs. Mediation or family meetings can help facilitate discussions and find mutually agreeable solutions.

Creditors may come forward with claims against the deceased person’s estate, potentially impacting the sale. It is essential to address these claims promptly and ensure that they are resolved before the sale proceeds.

Title issues can complicate the sale process. The personal representative should conduct a thorough title search to identify any potential issues and work with a title company to resolve them.

What Are the Timeframe and Costs Involved When Selling a House in Probate?

The timeframe and costs involved in selling a house in probate can vary depending on various factors. Here are some key points to consider:

- Timeline: The timeline for selling a house in probate can range from a few months to over a year, depending on the complexity of the estate and any potential disputes or challenges that arise. It is important to be prepared for a potentially lengthy process.

- Costs: Selling a house in probate involves certain costs, including court fees, legal expenses, and potential appraisal or inspection fees. These costs can vary depending on the specifics of the case and the services required.

- Factors influencing duration and expenses: Several factors can influence the duration and expenses of the probate sale process. These factors include the complexity of the estate, the presence of creditor claims, any disputes among family members, and the efficiency of the court system.

It is important to consult with a probate attorney to get a better understanding of the specific timeframe and costs associated with selling a house in probate in your particular situation.

What Is the Best Way to Sell a House in Probate?

When it comes to selling a house in probate, a cash home sale is often considered the best option. Here’s why:

In a cash home sale, the buyer provides a cashier’s check for the full purchase price, eliminating the need for financing contingencies or delays associated with mortgage approvals. Cash home sales are typically faster and more efficient than traditional sales. The entire process can be completed within a matter of weeks, allowing for a quicker distribution of proceeds to the beneficiaries.

Cash home buyers often purchase properties in as-is condition, relieving the personal representative of the burden of making repairs or renovations before the sale. Sales often involve direct transactions between the buyer and seller, eliminating the need for real estate agents and their associated commissions.

By opting for a cash home sale, you can simplify the process of selling a house in probate, expedite the sale, and ensure a quicker distribution of proceeds.

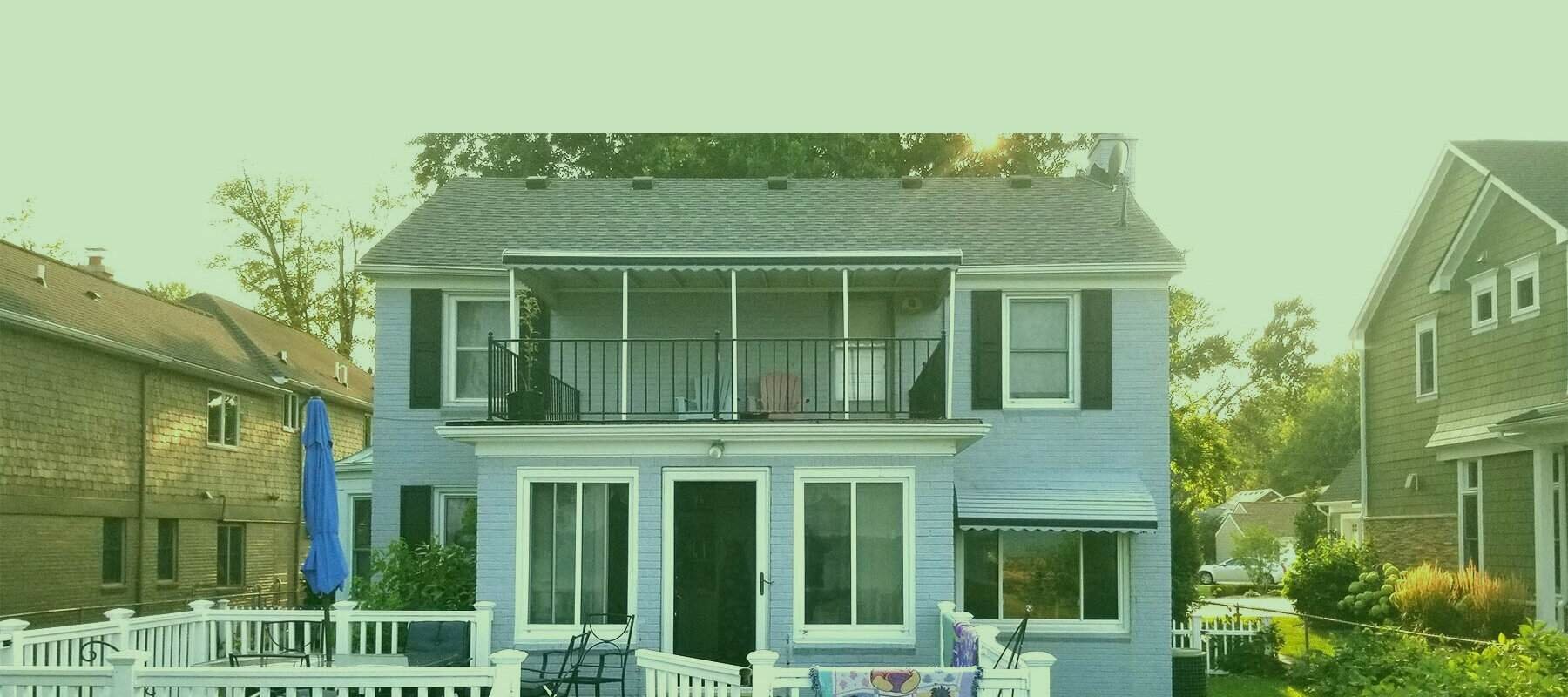

We Buy Houses in Detroit, Michigan

If you need to sell your house fast but don’t want the hassle of a traditional home sale, contact M1 Home Buyers. We buy houses as-is. No repairs are needed. Avoid closing costs and realtor commissions. Close in as little as seven days. Call 248-397-5800 to get a fast cash offer from our local home buyers.