If you are struggling to make your mortgage payments, you may be considering filing for bankruptcy. Bankruptcy is a legal process that can help you eliminate your debts and get a fresh start. However, many people wonder whether bankruptcy can wipe out their mortgage debt.

Below, we look at different types of bankruptcy, how bankruptcy affects mortgage debt, and whether bankruptcy can wipe out your mortgage debt. We will also discuss the process of filing for bankruptcy and alternatives to bankruptcy, such as an option to sell your house to avoid bankruptcy.

Types of Bankruptcy

There are two main types of bankruptcy that individuals can file for in Michigan: Chapter 7 bankruptcy and Chapter 13 bankruptcy.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is also known as a “liquidation” bankruptcy. In this type of bankruptcy, your non-exempt assets are sold to pay off your debts. However, most debtors who file for Chapter 7 bankruptcy do not have any non-exempt assets, so they are able to keep their property and possessions. Chapter 7 bankruptcy can eliminate most unsecured debts, such as credit card debt and medical bills.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is also known as a “reorganization” bankruptcy. In this type of bankruptcy, you create a repayment plan to pay off your debts over a period of three to five years. Chapter 13 bankruptcy can help you keep your property and possessions, but you must have a regular income to qualify.

How Bankruptcy Affects Mortgage Debt

Bankruptcy can affect your mortgage debt in different ways, depending on the type of bankruptcy you file for.

Chapter 7 Bankruptcy

If you file for Chapter 7 bankruptcy, your mortgage debt will not be discharged. This means that you will still be responsible for paying your mortgage after your bankruptcy is over. However, if you are behind on your mortgage payments, Chapter 7 bankruptcy can help you delay foreclosure proceedings and give you more time to catch up on your payments.

Chapter 13 Bankruptcy

If you file for Chapter 13 bankruptcy, your mortgage debt will be included in your repayment plan. This means that you will be able to catch up on your mortgage payments over a period of three to five years. Chapter 13 bankruptcy can also help you eliminate other debts, such as credit card debt and medical bills, which can make it easier to keep up with your mortgage payments.

Can Bankruptcy Wipe Out Mortgage Debt?

Unfortunately, bankruptcy cannot wipe out your mortgage debt. You will still be responsible for paying your mortgage after your bankruptcy is over. However, bankruptcy can help you eliminate other debts, which can make it easier to keep up with your mortgage payments. Additionally, if you are behind on your mortgage payments, bankruptcy can help you delay foreclosure proceedings and give you more time to catch up on your payments.

The Process of Filing for Bankruptcy

The process of filing for bankruptcy can be complex, and it is important to work with an experienced bankruptcy attorney. Here are the basic steps of the bankruptcy process:

- Step 1: Pre-filing Credit Counseling: Before you can file for bankruptcy, you must complete pre-filing credit counseling with an approved credit counseling agency. This counseling session will help you determine if bankruptcy is the right option for you.

- Step 2: Filing the Bankruptcy Petition: Once you have completed pre-filing credit counseling, you can file your bankruptcy petition with the court. This petition will include information about your debts, assets, income, and expenses.

- Step 3: Meeting of Creditors: After you file your bankruptcy petition, you will attend a meeting of creditors. This meeting is conducted by the bankruptcy trustee and gives your creditors an opportunity to ask you questions about your finances.

- Step 4: Completing the Bankruptcy Process: If you file for Chapter 7 bankruptcy, your non-exempt assets will be sold to pay off your debts. If you file for Chapter 13 bankruptcy, you will create a repayment plan to pay off your debts over a period of three to five years. Once you have completed the bankruptcy process, your debts will be discharged, and you will have a fresh start.

Alternatives to Bankruptcy – Cash Home Sale

If you are struggling to make your mortgage payments and do not want to file for bankruptcy, a cash home sale may be a good option for you. A cash home sale is when you sell your home to a real estate investor for cash. If you are considering a cash home sale, here are some factors to consider:

- Your financial situation

- Your timeline for selling the house

- The condition of your home

- The current real estate market in your area

Bankruptcy can be a helpful tool for eliminating your debts and getting a fresh start. However, it cannot wipe out your mortgage debt. If you are struggling to make your mortgage payments, a cash home sale may be a good alternative to bankruptcy. It is important to carefully consider your options and work with an experienced professional to make the best decision for your financial situation.

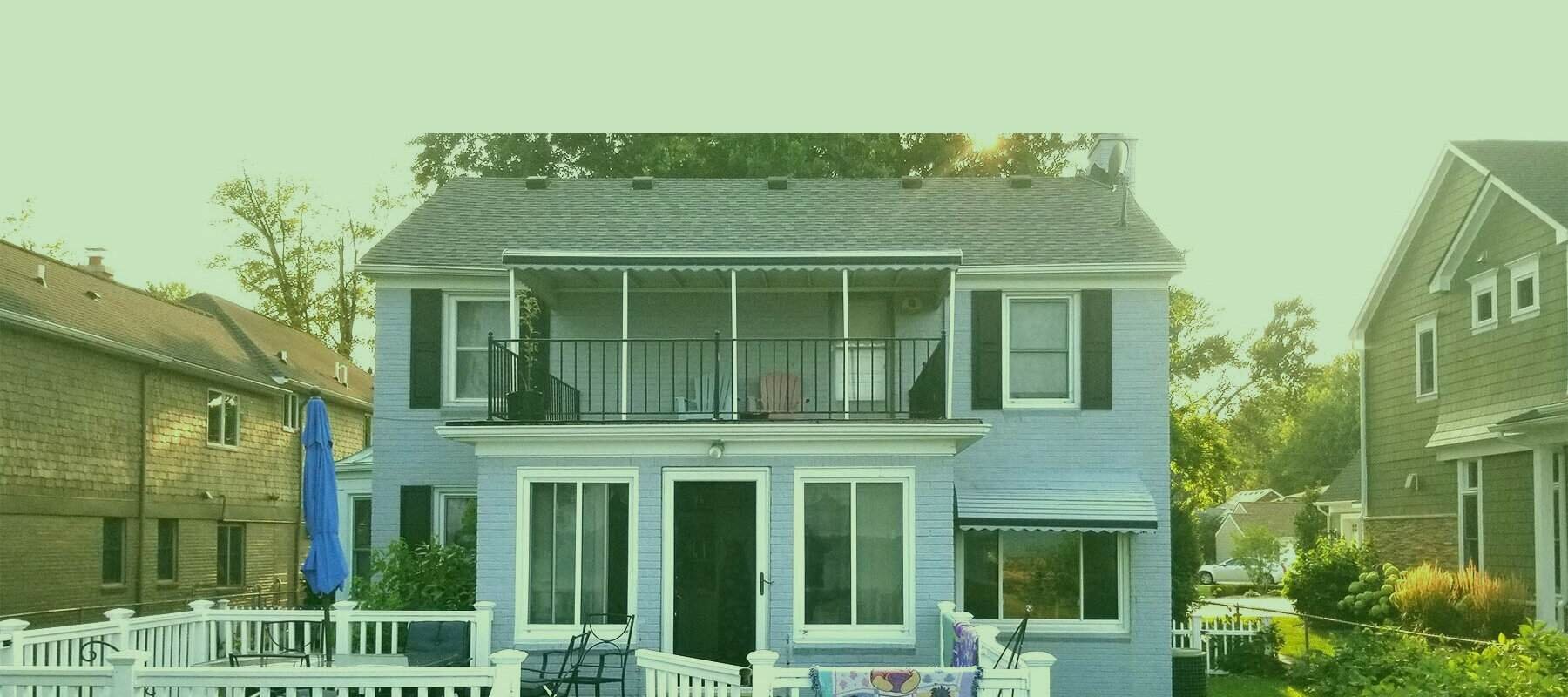

We Buy Houses in Detroit, Michigan

If you need to sell your house fast but don’t want the hassle of a traditional home sale, contact M1 Home Buyers. We buy houses as-is. No repairs are needed. Avoid closing costs and realtor commissions. Close in as little as seven days. Call 248-397-5800 to get a fast cash offer from our local home buyers.